Tax compliance is a challenging task for any business to manage, let alone multinationals or people who have to deal with international laws and regulations. Income, sales, and VAT tax requirements differ widely all over the world. Quaderno aims to simplify this process.

Through automated calculations and customizations based on you and your customer’s location, this tool allows users to track financial data like sales, inventory, and expenses across borders. It then calculates taxes, saving you time on paperwork and record-keeping.

Who Quaderno Is For

Quaderno streamlines sales tax, value-added tax (VAT), and goods and services tax (GST) compliance for digital businesses operating across borders with differing tax systems. Whether you run an online store or sell digital products like ebooks in a variety of countries and regions, Quaderno can save valuable time for ecommerce businesses.

Software as a Service (SaaS) companies also work well with Quaderno, thanks to features like automated recurring billing and international tax management. It’s great for streamlining tax calculations for freelancers and small business owners, too. Accountants and tax consultants can use it to calculate taxes and generate client invoices.

Quaderno Pricing

Quaderno offers transaction-based pricing that scales with your business. It counts a transaction when you create documents like invoices, receipts, or expense reports. New users can try it for seven days free of charge without entering payment details.

The Startup plan, which includes 250 transactions for $49 per month, is ideal for basic accounting needs.

If you need more volume, the Business plan increases the limit to 1,000 transactions at $99 monthly. This plan and the Startup plan both support multiple users and three registered locations.

Larger enterprises with more complex requirements may opt for the Growth plan, which extends the transaction maximum to 2,500 for $149 monthly while expanding registered locations to ten.

For high-transaction volumes over 2,500, you can contact a Quaderno representative to design a custom Enterprise plan tailored to your needs and budget.

All plans deliver unlimited user access, automatic receipt generation, tax alerts, and integrations with industry-leading software.

Pros and Cons of Quaderno

Quaderno is designed to remove much of the burden associated with cross-border financial management by automating the calculation of income, sales, VAT, and other taxes based on location data. It simplifies tax compliance so you don’t have to worry about dealing with messy spreadsheets and figuring out complex international rules on your own.

Quaderno Pros

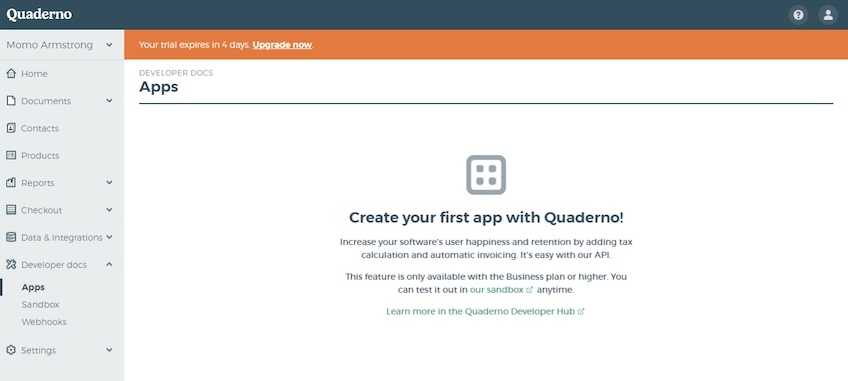

- Sandbox environments are available to test integrations, along with sandbox-to-sandbox testing.

- We received an automated compliance check for potential dual tax liabilities for different countries soon after joining.

- Quaderno houses all the collective data reports from all sales channels, platforms, and payment gateways in one dashboard.

- Adhering to global tax compliance with tax laws in any country, including US sales tax, VAT, and GST, is effortless and automatic.

- Calculating tax regulations correctly at any location eliminates the need to consult tax experts for remote and hybrid companies.

- Its pricing plan works for every budget, especially freelancers and small business owners.

- Quaderno provides detailed how-to examples and resources on its website and social media channels.

- The Report feature allows you to focus on sales and expenses or consult the support section of the website for more detail on reporting.

- Create or upload products in minutes, including a product image.

- The interface is easy to navigate without bloated menus and subpages.

Quaderno Cons

- The software may feel a little overwhelming at first when you’re just getting started, especially for complete beginners. Note that all plans include first-class support, though, if you need help.

- There are limited native payment integrations. You’ll need Zapier to connect with Deel or Wise, for instance.

- We couldn’t produce a report that combines several sub-reports, except manually. It is, however, possible to download each subreport as a CVS.

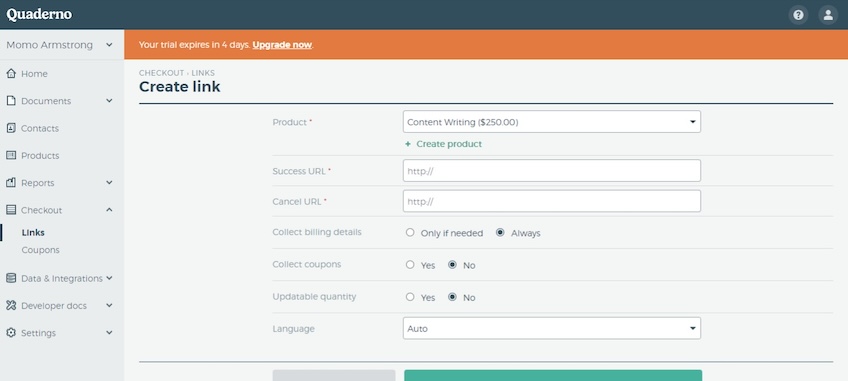

- The Checkout feature is surprisingly sparse. After adding a payment source like PayPal, the dashboard only allowed us to create tracking links and coupons.

Quaderno Review: The Details

Quaderno offers solutions for digital creators, ecommerce businesses, SaaS companies, and other companies that need help with international tax management. It offers products that help with tax registrations, calculations, reporting and filing, invoicing, and more.

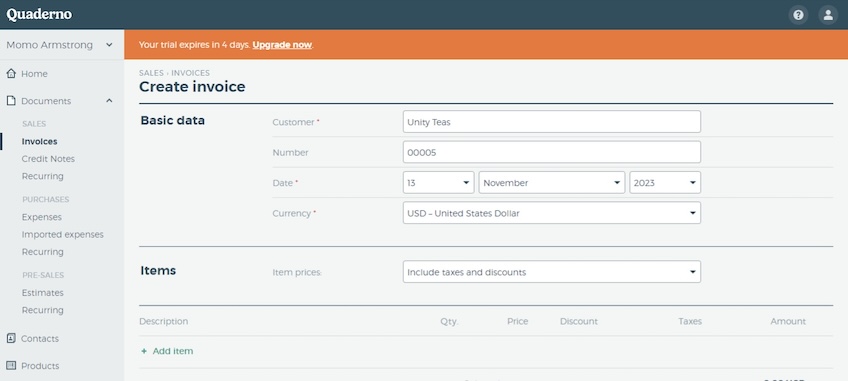

Invoicing and Documents

Quaderno’s Invoicing and Documents features help streamline core business operations. They simplify the way you manage financial transactions by automatically generating and customizing tax-compliant financial documents.

Upon receipt of payment, the Invoicing feature lets you apply the correct tax based on location and have invoices sent directly to customers in a timely fashion. Calculations are made according to worldwide regulations, removing the risk of human error. Currency conversions occur seamlessly based on official exchange rates, while also matching the style of invoices to your brand through templates.

The Documents feature goes beyond invoices to include receipts, credit notes, and expense reports. All documents can be tagged and analyzed to glean insights into sales trends and product performance. On top of that, you’re able to generate simplified receipts for low-value sales to meet specific legal or contextual requirements.

Both features integrate via Google Docs for easy collaboration. Or you can automatically create PDFs using PDF Blocks.

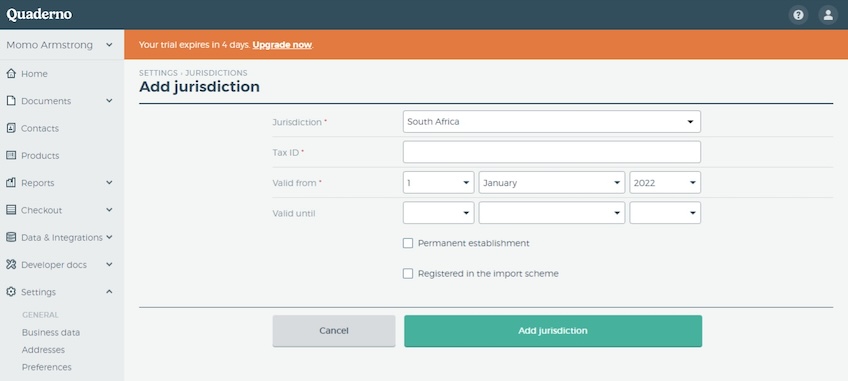

Compliance, Reporting, and Filing

With Quaderno, you have access to one of the largest tax jurisdiction databases in the world with over 14,000 regulations updated daily so you always get accurate calculations for each and every transaction. You’ll also get a team of certified advisors to help you understand statutory nuances regardless of your level of expertise.

Flexible integration options like an API, checkout tools, and over 15 connectors come included so you’re certain that data is being transmitted securely no matter what system you use. Quaderno provides encryption and complies with privacy laws worldwide.

The tax reports are clear and concise thanks to color-coded sections and detailed charts. Plus, you get proactive alerts for upcoming important dates or rate changes like when a quarterly report is due.

You also get audit-friendly and time-stamped documentation of all changes and revisions to documents. Data import and export is hassle-free, and transferring files to other systems takes just a few clicks. Exemptions, currency translation, and bespoke transactions are all handled behind the scenes—Quaderno automates it all.

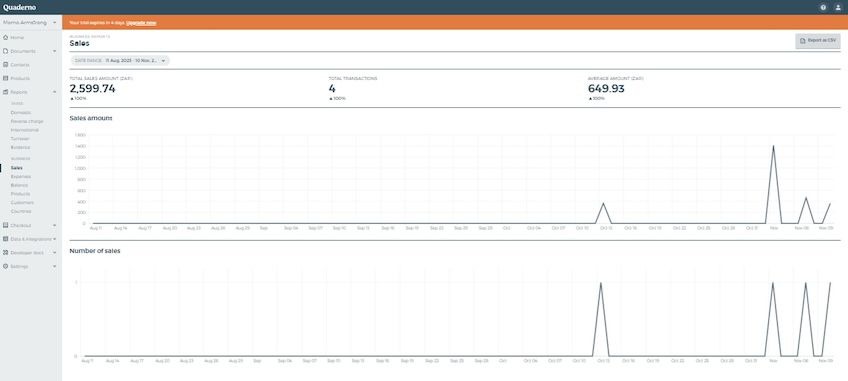

Reports and Analysis

Reports capture sales data from all your channels, like invoices, credit notes, and online transactions, and turn them into professional documents within customizable date ranges. With Quaderno, you’ll know if revenues are increasing month-over-month and which products are selling best.

Staying on top of taxes is effortless thanks to up-to-date tax information broken down by jurisdiction. No need to hunt down files—you’ll immediately see your exact sales tax, VAT, and GST amounts, which is convenient for testing different scenarios during development.

Best of all, you access this information in a single dashboard no matter what marketplace, payment processor, or direct booking you use. It can also verify VAT IDs for European B2B sales.

Quaderno lets you log and sync data from several platforms into accounting software, whether you use Xero or something else. You can even import updates via file or API to refresh your reports over time.

Checkout

Whether you sell digital goods, subscriptions, or both, the Checkout feature ensures your customers sail through the purchasing process. By embedding fully-compliant checkout forms into websites and shared links, you can boost sales no matter where your audience lives.

Handle all tax calculations and payments by combining Checkout with third-party payment apps. Subscriptions receive consistent, accurate tax applications regardless of frequency. Or, integrate with tools like WordPress, Shopify, and Stripe to build trust and compatibility with different customers.

It’s easy to disseminate custom, permanent URLs that are equipped with purchasing abilities, whether on tweets, emails, or posts. You can customize them somewhat to match language preference and VAT collection.

Quaderno works with apps like LearnWorlds to improve the accuracy of tax rates based on transactions, Easy Digital Downloads, which imports basic product details for you, and Zapier, which helps bridge the gap between payment partners.

Connecting with platforms like PayPal and Braintree brings peace of mind to customers because all major currencies, billing options, and subscriptions are standard. Tax rates are automatically managed across each payment iteration.

Products

Through the Products feature, you can create, alter, and view pricing options in one hub. Ensure the right tax rate adheres to each, whether testing or live. You’re able to send out unique promotional codes, too.

While this feature integrates with other Quaderno products, it is limited as a standalone solution when it comes to third-party platforms.

Solopreneurs and micro businesses seeking a one-stop checkout solution may find this offering under-whelming since you’ll need to rely on plug-ins or additional apps to make it work.

Connect and Developer

The Connect API helps your business grow internationally and comply with an ever-changing tax landscape by integrating tax management into existing systems. Whether you run an ecommerce store or software platform, it automatically calculates accurate taxes at the point of sale across hundreds of global tax regions.

Connect allows you to generate tailored and customer-compliant invoices for international sellers and buyers. It will notify you of any tax obligation changes right away so you’re always on top of shifts in global regulations.

Unlike some providers, Connect does not lock you into a single gateway. You just send transaction data to Quaderno after a sale or return and the API handles the rest regardless of payment method. This future-proofs your integration and keeps options open as your business changes.

The higher tier plans unlock more of Connect’s potential. For instance, the Business tier provides advanced tax management, support, and invoicing functions—perfect for companies with high transaction volumes. Furthermore, accountants can view reports and documentation for tax preparation and advisory services.

Developer tools optimize your integrations even more with hassle-free documentation, code samples, SDKs, and more. Support helps navigate updates to jurisdiction lines and tax standards whenever they occur.