Want to jump straight to the answer? The best business loan for most people is from Bluevine or SMB Compass.

From startups to companies that have been around for decades, it’s not uncommon for businesses to seek funding at one point or another. Loans can cover operating costs, purchase new equipment, buy inventory, help with expansion, and more.

Regardless of your company size or capital needs, you can find the best loan for your business using this guide.

Top 12 Best Business Loans for 2023

- Bluevine — Best for established businesses seeking lines of credit up to $250,000.

- SMB Compass —Best for small businesses seeking multiple loan options

- Funding Circle — Best small business lender for loan terms up to five years.

- Lendio — Best small business loan marketplace with 75+ lenders.

- OnDeck — Term loans and lines of credit for business owners with a 600+ FICO score.

- Fundbox — Best for new businesses in need of inventory or supplies from vendors.

- American Express Business Line of Credit — Best for businesses with low monthly or annual revenue.

- Lending Club — Best P2P lending marketplace for business loans.

- Kiva — Microloans up to $10,000 at 0% interest for entrepreneurs.

- SmartBiz — Best for SBA loans up to $5 million with 25 year terms.

- Credibility Capital — Bank-backed loans for business owners with great credit.

- CAN Capital — Best merchant cash advance for small business.

We’ll review each business loan below. You can use this information to decide which loan best fits the needs of your small business.

The Best Business Loan Reviews

Bluevine

Bluevine is one of the first places a business owner should look for a loan. You can get approved for a loan in just five minutes.

Applying online will not affect your credit score. Hard credit checks are only performed after you’ve reviewed and accepted an offer.

Bluevine offers lines of credit up to $250,000 with a decision made in just five minutes.

Bluevine’s main type of small business assistance comes in the form of a line of credit, which includes:

- Revolving line of credit to $250,000

- Only pay interest for the amount used

- No prepayment penalties

- Fast decision turnaround

The line of credit funds are available on-demand and very simple to request on the website. As your business grows and gets a better credit score, your line of credit will increase.

More than 500,000 business owners have used Bluevine for a loan. The company has provided more than $14 billion in loans to a wide range of business types across all industries.

There are some eligibility restrictions to consider. For example, to get a line of credit, you need to be in business for at least 24 months, earn at least $40,000 in monthly revenue, and have a 625+ FICO score.

This makes Bluevine a better choice for an established business as opposed to a startup company. Apply online.

SMB Compass

SMB Compass is a well-established name in the world of commercial lending. With more than 25 years of experience, it has helped over 1,250 businesses in all 50 states secure financing.

Cumulatively, the company has loaned over $250 million to businesses across a wide range of industries, from restaurants, hospitality, and retail to medical practices, construction companies, and many more. SMB Compass even offers loans to businesses in specific niches like veterinary practices, toy companies, staffing services, and franchise-based businesses.

One of the main reasons why SMB Compass is so appealing to small businesses is its wide array of lending options. Nine different types of loans and financing are offered, so there’s a good chance you’ll find a solution that properly funds your business and fits your needs.

Your options and lending limits include:

- Term loans of up to $5 million

- Lines of credit up to $5 million

- Inventory financing up to $10+ million

- SBA loans of up to $10 million

- Invoice financing up to $10+ million

- Asset-based loans of up to $10 million

- Bridge loans of up to $5 million

- Purchase order financing up to $10+ million

- Equipment financing of up to $5 million

Beyond that, SMB Compass also offers specialty lending options for different states and their most valuable industries. For example, you can secure a loan specifically for funding your resort in Las Vegas or your green energy company based in Washington.

Basic qualifications for SMB Compass loans and financing require that applicants provide three to six months of bank statements and demonstrate that they have been in business for at least two years.

Applying is simple. Just fill out a one-page online application to get started on securing one of SMB Compass’ many small business financing options.

Funding Circle

Funding Circle is a well-known and trusted name in the small business financing world. More than $19.4 billion has been lent to 130,000+ businesses throughout the globe on this platform.

It takes just six minutes to apply online for a loan from Funding Circle.

You can borrow between $25,000 and $500,000 and pay it back between six months and seven years. This type of flexibility is one of the many reasons why Funding Circle is such a popular choice for small business owners.

Try the Funding Circle loan calculation tool on their website. It’s a great way to calculate your monthly payments based on the amount you want to borrow and the loan term.

Another reason why we like Funding Circle is because they provide excellent customer service. You’ll hear back from a personal loan specialist within an hour of applying. Once your offer has been approved and accepted, you can usually access funds the following business day.

Lendio

Lendio is unique compared to some of the other lenders on our list. That’s because you won’t be borrowing money directly from them.

Instead, Lendio operates as a small business loan marketplace. They have a national network of more than 75 different lenders. PayPal, American Express, and Bank of America are just a few of the many companies that you’re familiar with. You’ll even recognize some names from our list of the best business credit cards.

Simply fill out an application, and you’ll be matched with the top lenders and loan terms to meet your needs. This is the best way to compare business loans from a single platform.

It takes just 15 minutes to apply, and there’s no fee or obligation. Once approved, you can have access to your funds in as little as 24 hours.

Lendio works with lenders providing:

- Business Lines of Credit

- SBA Loans

- Short Term Loans

- Business Term Loans

- Business Credit Cards

- Equipment Financing

- Commercial Mortgages

- Accounts Receivable Financing

- Startup Loans

- Business Acquisition Loans

Over $12 billion has been funded from 300,000+ loans in the Lendio marketplace. No matter what you need the capital for, Lendio is sure to have an option for you.

In some cases, Lendio will request additional information or documentation after you apply, which can sometimes be a pain. But if you’re not in a major rush to get a loan, this extra step is a non-issue. Apply online now.

OnDeck

OnDeck is a global leader in business financing. The company has loaned more than $15 billion to businesses across 700+ industries.

With OnDeck, you can access a term loan or a business line of credit. Here’s a quick overview of each option:

OnDeck Term Loan

- $5,000 to $250,000

- Term lengths up to 24 months

- Same day funding

- Daily or weekly payments

OnDeck Line of Credit

- Revolving line of $6,000 up to $100,000

- 12-month term lengths

- Weekly payments

To qualify for a loan with OnDeck, regardless of the loan type, you must meet the following minimum requirements:

- At least one year in business

- Personal FICO score 625+

- Annual revenue $100,000+

- Established business bank account

With that said, the typical OnDeck customer has been in business for more than three years, has a personal FICO score above 650, and does $300,000+ in annual revenue.

There’s some conflicting information online about OnDeck. Some websites claim this is a good place for business owners with bad credit. But you’ll still need to meet the minimum FICO requirements.

OnDeck does not offer funding to businesses based in certain industries. For example, adult entertainment materials, firearms, drug dispensaries, gambling services, and vehicle dealers will need to seek a loan elsewhere. You can view the full list of OnDeck restricted industries here.

Fundbox

More than 500,000 businesses have trusted Fundbox to finance their small business loans.

Fundbox is known for its simplicity and transparent pricing. It’s a great option for small business owners who don’t meet strict qualification terms from other lenders.

To get approved for a Fundbox loan, you need to meet the following qualifications:

- 600 minimum personal credit score

- Have a business checking account

- Provide three months of business banking activity (ideally 6+ months)

- Be registered in the US

Fundbox specializes in trade credit, which is also known as vendor credit or net terms. In these cases, your company can continue to purchase inventory and supplies directly from vendors. But the vendor will be paid by the lender, and your business repays the lender based on your term agreement.

You can get interest rates as low as 4.66% with Fundbox. They offer 12 and 24-week term options for repayment.

American Express Business Line of Credit

American Express offers small business funding in the form of revolving credit. You can get a credit line of up to $250,000 from this online lender.

With American Express, the application process is simple. You’ll get a decision within minutes of applying online. With that said, you must connect your bank account so the system can review your business performance.

You have to meet the following minimum requirements to get a loan from American Express:

- Be 18+ years old

- Business has been operating for at least one year

- Average revenue is at least $3,000 per month

- 660+ FICO score

This is a great alternative for business owners who don’t qualify for stricter revenue requirements that we’ve seen from other lenders.

The American Express Business Line of Credit offers 6, 12, and 18-month loan terms with no prepayment penalties. However, you will pay a fixed monthly fee in addition to the financing rate. The good news is that there are no prepayment penalties if you want to pay your balance off early.

Lending Club

Lending Club offers a wide range of loan options. In addition to business loans, they provide auto refinancing, personal loans, and patient solutions for healthcare bills. Altogether, over four million customers have borrowed $80+ billion from Lending Club.

Lending Club is another loan marketplace, similar to Lendio, which we reviewed earlier. However, Lending Club stands out because it’s a P2P lending network.

The money you borrow can come from individual investors.

In general, P2P lending has a reputation for high-interest rates since it involves more risk for the investor. But Lending Club has rates as low as 4.99% for qualifying borrowers.

Lending Club has business loans for:

- Inventory

- Debt consolidation

- Marketing

- Equipment

- Remodels

- Emergency repairs

- Acquisitions

Another reason to consider Lending Club is the loan terms. You can get all of your capital in a lump sum upfront and repay it with fixed terms for up to five years. There are no prepayment penalties.

Loan amounts range from $5,000 up to $500,000. You can get funded in just a few days if you qualify.

To get a business loan from Lending Club, you must be in business for at least one year and have at least $50,000 in annual sales. You must own at least 20% of the business and be based in the U.S.

Kiva

Kiva is a nonprofit organization. This allows them to offer business loans at 0% interest. Yes, you heard that right; 0%.

More than 2.5 million people have used Kiva to raise $1+ billion.

This platform is designed to create opportunities for entrepreneurs in the United States.

Benefiting from 0% interest does come at a cost. Kiva can only be used for microloans of up to $15,000. There is also a lengthy process to apply and get funded.

First, you’ll have to fill out an application that takes up to 30 minutes. Then you’ll spend 15 days getting your friends and family to lend you money “to prove your creditworthiness.” Next, you can go public on the Kiva marketplace, where your loan will be visible to more than 1.6 million lenders across the globe.

Basically, Kiva is a mix between crowdfunding and P2P lending. You’ll have up to 36 months to repay the loan.

If you need fast access to large sums of cash, Kiva is not for you. But for small business owners who aren’t in a hurry to get a microloan, Kiva is the best way to avoid interest fees.

SmartBiz

In most instances, you’ll need to visit a bank to get an SBA loan. These are government-backed loans that give businesses access to cash at favorable rates.

Fortunately, you can get an SBA loan directly from banks in the SmartBiz marketplace.

SmartBiz has SBA loans for up to $500,000, with interest rates between 11.25% and 12.25%. Loan terms are 10 years.

These favorable rates do come with stricter qualification terms. For example, get an SBA loan between $30,000 and $500,000 for working capital or debt refinancing, you must:

- Be in business for 2+ years

- Have a personal credit score above 650

- Be a US citizen or legal permanent resident who is at least 21 years old

- Own and operate the business in the US

- No outstanding tax liens

- No foreclosures in the past three years

- No bankruptcies in the past three years

- Be up to date on all other current government loan payments

While it’s harder to qualify, you’ll benefit from favorable lending terms. SmartBiz has other loans that aren’t SBA-backed. But we’d only consider using this platform if you’re seeking an SBA loan.

Credibility Capital

Credibility Capital specializes in small business loans. All of their loans are bank-backed, which gives them the ability to provide lower rates than other financing options on our list.

Loans range from $25,000 to $350,000.

Each loan is paid back monthly over one, two, or three-year terms. Interest rates start at 8%. There is no application fee. However, Credibility Capital charges origination fees starting at 3%. Fortunately, there are no prepayment penalties if you want to pay the loan off early.

Here are the eligibility requirements for Credibility Capital loans:

- 2+ years in business

- Business is currently generating revenue

- Business owner is a US citizen

- Strong personal credit

- No bankruptcies in the last five years

- Businesses located in Vermont, North Dakota, South Dakota, or Nevada are NOT eligible

The information on their website is fairly limited. You’ll need to start an application to see more details about your financing options.

CAN Capital

CAN Capital has been served 81,000+ businesses for more than 20 years. During that time, they’ve loaned more than $7 billion to small business owners.

With CAN Capital, you can get access to funding quickly with minimal paperwork. Most decisions are made within a few hours of applying, and funds can be released as soon as the next business day.

They offer loans from $2,500 to $250,000. In addition to short-term business loans, CAN Capital also provides equipment financing.

Repayment terms range from 6-24 months, regardless of your loan type.

There’s an origination fee of 3% on short-term loans.

How to Find the Best Business Loan For You

With so many business loan options to choose from, finding the best loan for your small business can be challenging. Getting a business loan is a big deal, so don’t rush through this process.

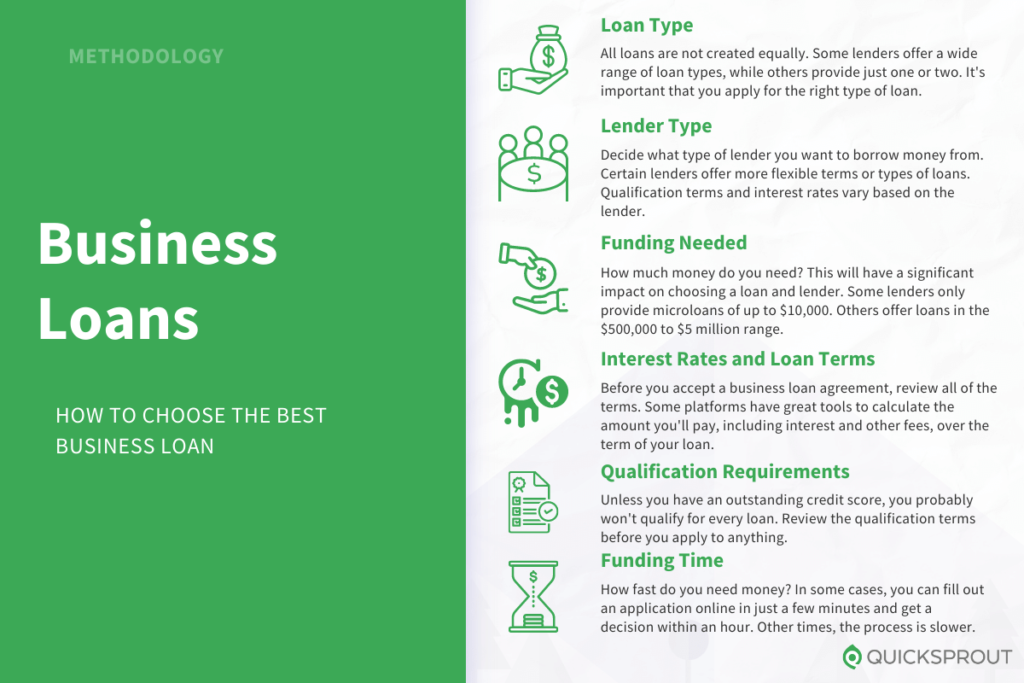

There are certain factors that must be taken into consideration when you’re evaluating a prospective loan or lender. This is the methodology that we used to narrow down the choices on our list. You can use the same criteria during your search.

Loan Type

All loans are not created equally. Some lenders offer a wide range of loan types, while others provide just one or two. Common types of small business loans include:

- Installment Loans — Lump sum of cash paid back in fixed installments over the term length.

- Business Line of Credit — Revolving line of funds that can be drawn at any time. Interest is only paid on the amount borrowed, as opposed to the full amount of the credit line.

- SBA Loans — Loans with lower interest rates backed by the Federal government.

- Short-Term Loan — Lump sum of cash that must be paid back in fixed installments over a shorter period than an installment loan. Some short term loans typically range from 12 weeks to 18 months.

- Equipment Loans — Must be used to purchase business equipment. In many cases, the equipment is used as collateral to secure the loan.

- Merchant Cash Advance — Money borrowed against future revenue, typically repaid as a percentage of daily or weekly credit card sales.

It’s important that you apply for the right type of loan. For example, certain loans can only be used for real estate. So you wouldn’t be able to use those funds to purchase inventory.

Lender Type

Decide what type of lender you want to borrow money from. Certain lenders offer more flexible terms or types of loans. Lenders typically fall into one of the following categories:

- Big national banks

- Small local banks

- Credit unions

- Alternative lenders

- Loan marketplaces

- Nonprofit lenders

- Crowdfunding services

- P2P lending

Qualification terms and interest rates vary based on the lender. For example, a P2P lending platform might offer loans to business owners with poor credit, but the interest rates will be much higher than an SBA loan from a bank.

Funding Needed

How much money do you need?

This will have a significant impact on choosing a loan and lender. Some lenders on our list only provide microloans of up to $15,000. Others offer loans in the $500,000 to $10 million range.

Make sure you choose a lending option that can provide you with adequate funding.

Interest Rates and Loan Terms

Before you accept a business loan agreement, review all of the terms. Some platforms have great tools to calculate the amount you’ll pay, including interest and other fees, over the term of your loan.

Shop around for the best interest rates for your loan type. If you have excellent credit, you’ll be able to get more favorable terms.

Always try to get the longest loan term for the lowest interest rate. We only recommend loans with no prepayment penalties. So you can pay it off early to avoid added interest charges.

Some loans come with other charges, like a fixed monthly fee or an origination fee. While a 3% origination fee might not sound like much, it gets quite expensive as you start looking at six-figure loans.

Qualification Requirements

Unless you have an outstanding credit score, you probably won’t qualify for every loan. Review the qualification terms before you apply to anything. Otherwise, you’re just wasting your time.

Common loan qualification terms include:

- Minimum credit score

- Location of business

- Age of the business owner

- Years the business has been operating

- Minimum monthly or annual revenue

These requirements are usually easy to find on every lending website.

Funding Time

How fast do you need money?

In some cases, you can fill out an application online in just a few minutes and get a decision within the hour. Other times, the application process is a bit slower.

Some business loans provide same-day or next-day funding once you’ve been approved. You’ll have to wait days, weeks, or even months (rarely) in other cases to get your hands on cash from some lenders.

Unless it’s an emergency, getting next-day funding shouldn’t be the deciding factor. We’d rather get a loan with lower interest rates and favorable terms, even if it takes a bit longer to get funded.

The Top Small Business Loans in Summary

The best small business loans give you working capital for your business. These loans can range anywhere from $15,000 to $1+ million.

While you may be tempted visit your local bank or credit union. The best business loans typically come from online lenders and alternative financing options.