Want to jump straight to the answer? The best accounting software for most small businesses is QuickBooks or Zoho Books.

Accurate bookkeeping is one of the most underrated assets of any small business.

The best accounting software saves you time and energy every day. If you don’t have it yet, you’ll be surprised how little it costs for the value.

The 8 Best Accounting Software Solutions for 2022

- QuickBooks – Best small business accounting software for new businesses

- Zoho Books – Best value solution for large lists of customers and vendors

- FreshBooks – Best invoicing software for entrepreneurs, agencies, and SMBs

- Melio – Best free business payment solution to pay and get paid via ACH, check, or credit card.

- Sage 50cloud – Best desktop solution for medium-sized businesses

- Wave – Best free accounting software for entrepreneurs

- Xero – Best for data imports and Gusto payroll integration

- Kashoo – Best straightforward, all inclusive pricing

Read on for in-depth reviews including the pricing, pros, and cons of each tool on my list. Use this as a guide for comparing your options.

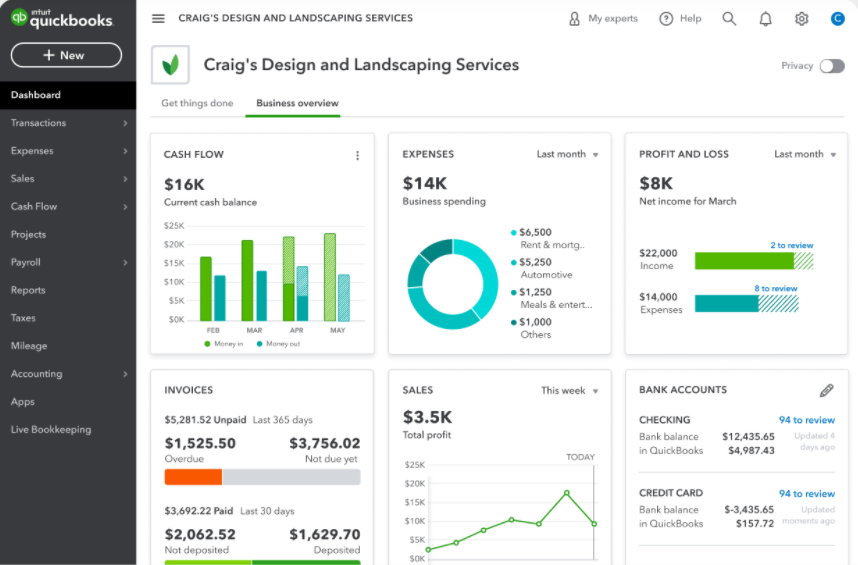

QuickBooks – Best Small Business Account Software For New Businesses

QuickBooks is an incredibly popular accounting solution — and for very good reason.

They offer robust software for enterprises, accountants, small business owners, self-employed individuals, and everything in between.

Today, most people run everything through QuickBooks Online, which lets them handle more than just accounting. QuickBooks offers POS, time tracking, payroll and other integrated services–everything a small business needs under one roof.

We like this software because of how intuitive it is. It’s easy to keep everything organized with the QuickBooks dashboard. You’ll always have a real-time snapshot of your expenses, profits and losses, sales, income, and bank accounts.

Sync QuickBooks Online with your bank. The software will automatically import and categorize transactions accordingly. To manage receipts and expenses, simply take a picture of your bill using the mobile app. You no longer have to worry about losing and organizing paper receipts in your office.

Here’s an overview of plans and pricing for QuickBooks Online:

- Simple Start — $15 per month

- Essentials — $27.50 per month

- Plus — $42.50 per month

- Advanced — $100 per month

All small business plans allow you to maximize tax deductions, track miles, manage 1099 contractors, run general reports, send estimates, and invoice customers. If you want to manage bills, track time, inventory, and profitability, you’ll need to sign up for the Essentials plan.

QuickBooks Online integrates with popular apps that you’re already using to run your business, like Square, PayPal, and Shopify.

You can try QuickBooks free for 30 days or get 50% off your first three months. Since there are no long-term contracts or commitments, you can cancel or switch plans at any time.

Unfortunately, you can’t try the software for free and get the discount off of your first three months; you’re forced to choose between the two options.

Each QuickBooks plan limits the number of users who can access the system, and your accountant counts as one of those users. So just keep all of this in mind before you select a plan.

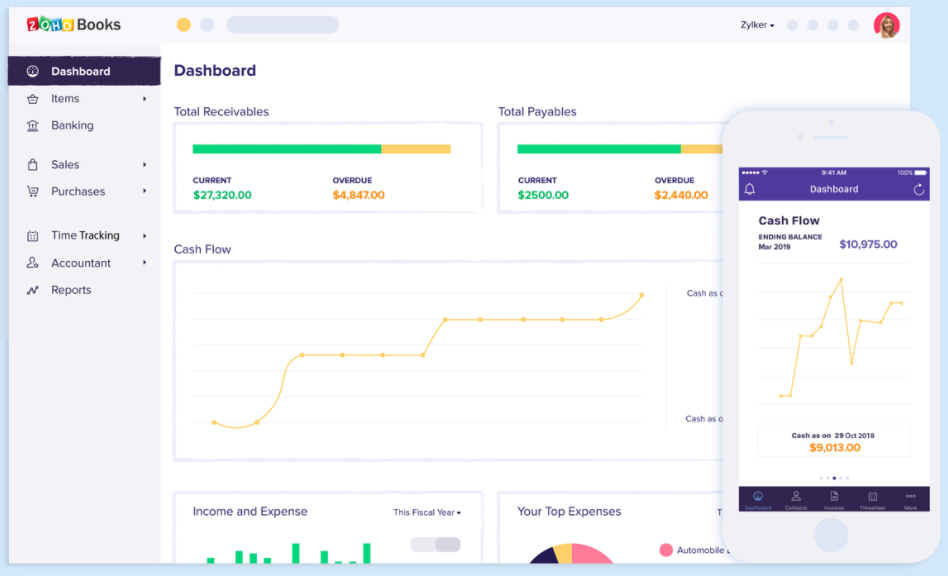

Zoho Books – Best Value Solution For Large Lists of Customers and Vendors

Zoho Books assists you with everything from daily transactions to negotiating deals and invoicing.

Like all Zoho tools, you get a simple platform that you can customize to fit your needs. There’s not a huge learning curve, despite the fact you can do a lot.

The small business software ensures tax compliance as well. You’ll easily understand your tax liability. You’ll also be able to prepare for audits in accordance with IRS guidelines.

We like the Zoho Books dashboard because it’s straightforward and easy to use. This is true whether you are on a desktop or your mobile phone.

Navigate through the most common accounting needs like:

- Inventory

- Banking

- Reports

- Receivables

- Payables

Zoho Books integrates with 40+ apps right out of the box. Similar to FreshBooks, the number of apps is a bit low compared to the competition; but the essentials are available.

In addition to the features, pricing for Zoho Books is based on the number of contacts on your account. Contacts are defined as customers and vendors who you can create transactions for in your books.

Here’s a brief overview of the three pricing plans:

Free

- 1 User + 1 Accountant

- Manage Clients

- Manage invoices

Standard — $20 per month

- Up to 5000 invoices

- Recurring expenses

- Bulk updates

Professional — $20 per month

- Track project expenses and invoices

- Retainer invoices

- Timesheet and billing

All plans come with bank reconciliation, expense tracking, customer invoicing, recurring transactions, sales approval, and timesheets.

The Free plan is good — especially if you’re a smaller business. Other beginner plans that we’ve seen in this guide start as low as five contacts.

Overall, the Standard plan is the best value. In addition to the larger contacts list, it also comes with billing, vendor credits, purchase approvals, reporting tags, budgeting features, and Twilio integration.

It’s easily scalable though. That means if your business grows, the software grows with you.

You can add users to any plan for an additional $2 per month or $20 per year.

Zoho Books has a 14-day free trial available for all plans. They offer month-to-month billing at the prices listed above, or annual contracts with two months free.

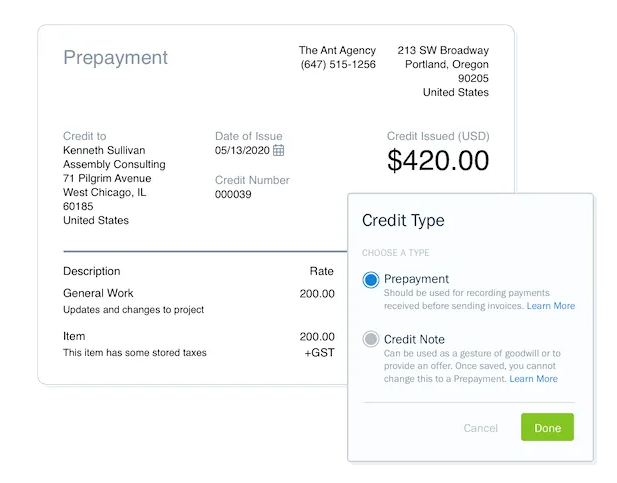

FreshBooks – Best Invoicing Software For Entrepreneurs, Agencies, and SMBs

FreshBooks specializes in accounting software for entrepreneurs and agencies because of their scalability.

If your business has room to grow — or you’re growing your list of customers — FreshBooks should be a top option for you to consider.

FreshBooks stands out as the best SMB accounting software for invoicing. But it also has tools for managing expenses, tracking time, managing projects, tracking payments, and generating reports.

Getting starting and running your FreshBooks account is a breeze. You don’t have any experience with small business accounting tools.

What we love about FreshBooks their mobile app. It’s an ideal solution for managing your small business bookkeeping and invoicing on the go.

While the list of app integrations isn’t as extensive as some other solutions in this guide, FreshBooks is still compatible with all of the most popular ones, like G Suite, Stripe, Shopify, and Gusto.

Here’s a quick overview of FreshBooks pricing:

- Lite — $8.50 per month

- Plus — $15 per month

- Premium — $27.50 per month

- Select — Custom pricing

The Lite, Plus, and Premium plans come with 5, 50, and 500 billable clients, respectively. So you can choose your plan based on the size of your client list. It’s an extra $10 per month for each team member that has access to the software.

Even if you’re a freelancer or just working part-time, I’d still start with the Plus plan. You don’t want to be restricted to just five billable clients in a given month. You can sign up for a free trial to see what plan is best for your business.

FreshBooks has outstanding customer support and plenty of resources, like links to training videos directly from your dashboard.

There are downsides though. The invoices are a bit limited in terms of what you can customize, and it doesn’t help you prepare quarterly tax estimates.

Melio – Best free business payment solution to pay and get paid via ACH, check or credit card

Melio is an accounts payable solution made specifically to support freelancers, entrepreneurs, and small businesses. Melio is free software that allows you to pay any vendor invoice via ACH or debit card for free through their online portal.

There are no monthly subscription, set up, or maintenance fees at all. The only fees Melio imposes are on credit card transactions, which is a 2.9% fee, which is still competitive. And you are not charged that fee if you receive a credit card payment.

Because Melio cuts a check and sends it to your vendors, you can now pay invoices with an ACH transfer, credit, or debit card, even if the vendor does not accept those forms of payment. Melio accepts Visa, American Express, MasterCard, Discover, and Diners.

Unlike PayPal or Venmo, Melio is meant for businesses. You cannot use it to send or receive personal payments.

ACH and credit card payments process in one to three business days and a physical check can take up to five business days. You can track payments to ensure your vendors are paid on time.

Melio is currently available only in a browser but has a mobile-responsive site and can be accessed from any internet-enabled device. It may only integrate with QuickBooks Online right this moment, but more integrations are coming soon, including QuickBooks for desktop, Xero, and Freshbooks.

Melio syncs with QuickBooks Online to created automated scheduling, and the Bill Pay feature can automatically capture details for bills and invoices. You can either manually enter details, upload the invoice to the site, or simply take a photo of the invoice. Then when you want to send a payment, schedule it for immediately or another day. Melio mails a check or deposits the money directly in the vendor’s account.

If you aren’t ready to sign up and start using Melio for free, you can try out an interactive demo on the website with an easy-to-use interface and sample invoices. If you’re looking for a simple B2B payment solution, Melio is great.

Sage 50cloud – Best Desktop Solution For Medium-Sized Businesses

For nearly four decades, the Sage brand has been providing enterprise-grade accounting solutions to companies across the globe. Sage 50cloud is an ideal solution for both small and medium-sized businesses.

The software is robust and sophisticated. It’s desktop software with remote access from anywhere.

Sage 50cloud has inventory management, accounts receivable functionality, report generation, and integrated payroll features. It’s great for small businesses that need multi-user access.

The security capabilities allow you to restrict access or limit functions to users in your company based on their clearance level or task description.

Sage has been around for a while, and it shows (not always in the best way). The user interface looks dated compared to other solutions on the market today. It doesn’t have any features for time tracking and lots of links open new windows, which isn’t very user-friendly.

Pricing for Sage 50cloud is a bit higher compared to other options on our list:

- Pro Accounting — $51.45 per month

- Premium Accounting — $86.92 per month

- Quantum Accounting — $144 per month

Prices will increase based on the number of users you add. You can also include Microsoft Office 365 for an additional $150 per year.

These price points aren’t as appealing for entrepreneurs, sole proprietors, and startups. We would only consider Sage 50cloud as a medium-sized business that needs the resources and assistance of a company like Sage.

We also recommend an annual contract to save some money on the already high prices.

Wave – Best Free Accounting Software For Entrepreneurs

Wave is a free accounting solution for entrepreneurs. That’s right—free. There are no setup fees, hidden costs, or monthly charges.

Here’s a list of everything you get for free using Wave:

- Income and expense tracking

- Bank and credit card connections

- Unlimited guest collaborators

- Invoicing in any currency

- Send estimates and turn them into invoices once approved

- Receipt scanning

- Automatic receipt recording

Use the Wave mobile app to manage everything you need on the go. You can even capture receipts when you’re offline, and they’ll upload when you connect.

You can manage multiple businesses with one Wave account, which is perfect for any entrepreneur. Personalize your invoices with customizable and professional templates as well.

The usability, features, and mobile app rival some of the best paid accounting solutions on the market today. The fact that you can use Wave for free is incredible.

You’ll only have to pay if you enable online payments or payroll with Wave.

Online payments are billed per use, at industry-competitive rates. ACH transfers are 1% per transaction with a $1 minimum fee. Credit card processing is 2.9% plus $0.30 per transaction.

Payroll starts at $20 or $30 per month, depending on your state. You’ll also be charged an additional $4 per active employee and $4 per contractor paid.

Overall, Wave is perfect for entrepreneurs looking for a basic accounting solution. It’s pretty limited outside of the standard features. Both the app and payroll integrations aren’t as useful as other solutions on my list.

Xero – Best For Data imports and Gusto Payroll Integration

Xero does a great job of simplifying the accounting process for small business owners.

It supports all of the basic features that you would expect in an SMB accounting solution, like sales, expenses, inventory, and payroll. You can even manage purchase orders, quotes, and invoices for your customers and suppliers.

For those of you who are using Microsoft Excel or another tool to manage your books, there’s a good chance that you’ve created lots of data. Xero makes it easy for you to import those transactions and other data into their software.

Xero has just three plans for you to choose from, each representing the stage of a small business:

Early — $6.50 per month

- Ability to send 5 invoices

- Ability to enter 5 bills

- Reconcile 20 bank transactions

Growing — $18.50 per month

- Unlimited invoices and quotes

- Unlimited bills

- Unlimited bank reconciliations

Established — $35 per month

- All features of the Growing plan

- Multi-currency compatibility

- Capture and manage expenses

- Track project times and cost

The plans are very straightforward. Although we wouldn’t recommend the Early plan to anyone; it’s extremely limited. Even if you’re just starting, you’ll outgrow it pretty quickly.

If you want to upload receipts to manage expenses with Xero, you need to upgrade to the Established plan. It’s worth noting that QuickBooks includes this feature with all plans, starting at less than half the price of Xero Established.

You can try Xero free for 30 days, or get 25% off of your first 3 months. We recommend the free trial promotion if you’re on the fence.

Xero stands out because of its integration with more than 800 business apps. More specifically, it’s great for small businesses using Gusto for payroll. But Xero falls a bit short with its mobile app and customer support.

Kashoo – Most Straightforward, All-inclusive Pricing

Despite the quirky name, Kashoo is an exceptional accounting solution for small business owners. We like Kashoo because it’s simple, and ideal for users seeking bookkeeping automation.

Kashoo makes it easy for you send invoices, get paid, and generate financial reports with just one click. These reports allow you to prepare accurate tax filings and make crucial business decisions.

The dashboard gives you a snapshot view of your business in real-time. You can also sync your bank accounts for easy and automated reconciliations.

Another top benefit of Kashoo is its usability. It makes everything easy for you to understand, even if you’re not an accountant.

Setup with Kashoo is seamless. Entering information about your business, taxes, invoices, and other settings are simple and easy to follow.

It’s worth noting that the client and supplier information won’t be as detailed as other platforms, like Zoho Books, but the ability to manage those contacts is still available.

Not every SMB accounting solution offers time-tracking tools—Kashoo does. So if this is a feature that you’re looking for, Kashoo should definitely be on your radar.

Kashoo has the most straightforward and affordable pricing on the market. There are just two plans, with everything all-inclusive. Just decide if you want an annual or month-to-month contract.

Kashoo truly small costs $216 per year, and the regular plan costs $324 per year. You can try it free for 14 days with a trial.

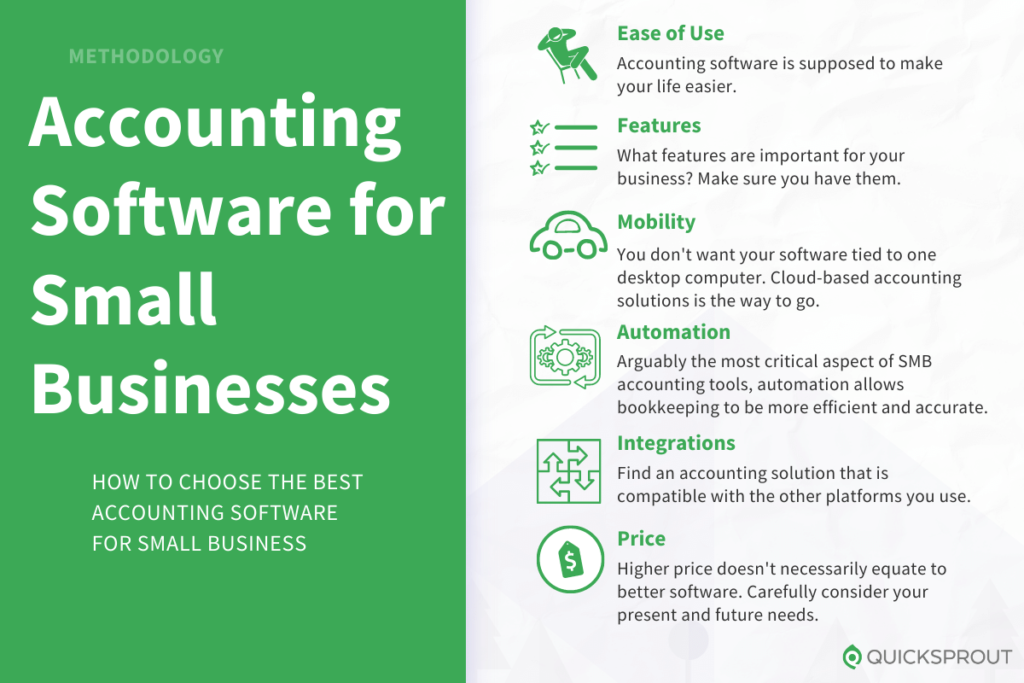

How to Find The Best SMB Accounting Software

Now that you’ve had a chance to check out the best accounting solutions, it’s time to choose one for your business. How can you decide between them?

There are certain factors that need to be taken into consideration when you’re evaluating SMB accounting software. This is the methodology that we used to come up with my list, so you can use it as well.

Ease of Use

Accounting software is supposed to make your life easier. So avoid anything that’s difficult to set up and use on a daily basis.

Keep in mind; you might be sharing this software with your bookkeeper, accountant, and other members of your team. The onboarding and training needs to be simple for everyone, regardless of their skill level.

Features

Some software specializes in certain features. For example, FreshBooks is best for invoicing, while Zoho Books is best for managing contacts. What features are important to you?

All of the tools on our list address basic accounting needs. But some are limited in terms of things like expense management or bank reconciliation. Sometimes you’ll need to upgrade your plan in order to get all of the features you want.

Mobility

We prefer cloud-based accounting solutions. You don’t want your software tied to just one desktop computer. You should be able to access it remotely from anywhere on the web or from a mobile app.

One of the best mobility features on the market today is expense management via receipt photos. The best accounting software will let you upload a paper or digital receipt from your mobile device, so you won’t have to a file with extra paperwork. Just snap a photo, and your software can automatically categorize the expense.

Automation

Automation is arguably the most critical aspect of SMB accounting tools. We always lean toward software that requires the least amount of manual work.

Once you can automate tasks like generating reports, sending invoices, and reconciling bank statements, your bookkeeping will be more efficient and more accurate than ever before.

Integrations

Every tool on the list above integrates with third-party solutions to an extent. Some solutions have hundreds of integrations, while others have a few dozen.

There are integrations for payment processing, ecommerce, CRM, payroll, and more. If you’re already using other platforms to run your small business, you should definitely find an accounting solution that’s compatible with them.

Price

Obviously, price is something that always needs to be taken into consideration. A higher price doesn’t necessarily equate to better software.

You don’t need to spend a ton of money here. There are even free solutions, like Wave, that are perfect for entrepreneurs.

No matter what plan you choose, we suggest looking ahead to upgrades. You want to make sure that your SMB accounting software makes it easier for you to scale without drastic price jumps. So don’t base your decision on the entry-level pricing alone.

The Value of Accounting Software for Your Small Business

Bookkeeping is complicated (to say the least).

We have consulted with so many small business owners who struggle with the basics, like tracking income and paying their bills.

Luckily, great accounting software makes your life MUCH easier. Not only can it automate tasks like invoicing for you, but it’ll also generate reports that help you make crucial business decisions.

Can you buy new equipment? Is your marketing budget sustainable? Do you need to secure a small business loan? Is your company profitable? Without the right accounting tools, most small business owners are forced to guess.

SMB accounting software makes it easy for you to track revenue, manage expenses, invoice clients, and reconcile bank statements.

Small business bookkeeping software improves accuracy, so you’ll have fewer errors compared to manually-generated reports. Accounting tools help ensure tax compliance and follow GAAP (generally accepted accounting principles).

Once you choose the right accounting software, you’ll be able to make smarter business decisions and have more time to focus on other areas of your company.

The Top Business Accounting Software in Summary

Accounting tools save you time, money, and help you make crucial business decisions. If the people in charge aren’t on top of the books, a seemingly thriving business can collapse overnight.

A firm grasp on the numbers keeps you in business during the down times and helps you grow during the good times. And if you’re using something clunky, you owe it to yourself to see just how streamlined modern accounting software has become.