Business success often hinges on proper cash flow management, including everything from handling expenses and purchasing inventory to maintaining equipment and paying wages. Given the demanding costs of running a business, credit solutions are often necessary to manage these bills, cover unexpected expenses, and jump on market opportunities.

Enter Credit Suite, a business credit solution with a promise to tackle these challenges with you. It can help you open credit lines and explore your financing options even if you have a poor record.

The following is our review of Credit Suite’s notable features, successes, and potential areas for improvement. It covers everything from the platform’s user interface to customer service so you can make a sound judgment on whether it can be a good solution for you.

Who Credit Suite Is For

Credit Suite touts itself as a robust financial platform designed to assist businesses in securing credit and capital through credit lines and loans. It caters to a wide range of audiences, from small companies to medium-sized corporations. Even with previous credit issues, entrepreneurs and small business owners who require funding to start up, develop, or expand can enroll.

For mid-size businesses and SMEs, which typically seek additional financing for growth, operations, and new projects, Credit Suite will work with them on their financial foundations before approaching lenders. This can help them obtain a broader selection of financing options in the future, including higher amounts of initial funding.

Those looking to start a franchise can also benefit from Credit Suite’s services, which can help secure the funding necessary to get up and running. Similarly, businesses that are doing well and want to enter new markets or develop new products can find financing solutions to do so.

On the flip side, companies that occasionally experience down periods where expenses exceed income can also obtain credit or other financing solutions to help bridge those gaps.

Lastly, there’s even a partner program for business advisors, consultants, and coaches who would like to offer business credit and financing solutions to their own clients.

Credit Suite Pricing

Credit Suite Core Program:

Credit Suite has some very confusing pricing information on its website. First, if you click on the Pricing link in the main navigation menu, you’re taken to a page that offers a couple of different pricing options for its core program. For example, you can pay seven monthly payments for $597 per month, or you can opt to make one single payment for $2,997.

Additionally, this pricing page also offers a payment method called Credit Key, which includes all the same features of its core program—only in this case it’s implied that you’ll be taking out a loan to reduce your monthly payments. This program requires approval, but with Credit Key, you can apparently drop your monthly payments down to as low as $282.

All of this is rather straightforward, but things get dicey when you start to look at the next bit.

Fundability System:

If you head back to the navigation bar of Credit Suite’s website and instead click on the Fundability link that appears in a dropdown menu when you hover over Pricing, you’re taken to a different page with pricing options for an offering that looks indistinguishable from the core program.

Here, you’ll find monthly payments for $497 per month with no mention of a 7-month term, semi-annual payments of $1,997 every six months, and a familiar single payment option for $2,997.

What’s included:

Regardless of whichever pricing or program you opt for, it appears that you get the same Credit Suite features. This includes monthly checks of your business’s financial profile to identify strengths and weaknesses in the eyes of potential lenders—as well as access to financial coaching, roadmaps, and other credit-building tools.

As your credit scores improve over time, the platform suggests that more financing partners will become accessible to you. Live assistance from Credit Suite representatives is also available throughout the process, so you don’t have to worry about your level of financial experience.

Currently, Credit Suite includes upcoming perks like cash flow monitoring and access to credit bureau insights in its offering, but it’s unclear when those features will be available.

Pros and Cons of Credit Suite

Anything related to your business’s financial needs and objectives deserves a critical approach to the upsides and downsides, and Credit Suite is no different.

Credit Suite Pros

- The process is straightforward and accessible for all businesses regardless of past experience. It’s also equipped to deliver tailored solutions for those with bad credit scores or previously rejected loan applications.

- You gain valuable insider knowledge on tactics that can boost your credit profile over time and make you look like a safe bet to lenders. This is a recipe for successful borrowing.

- In addition to loans, Credit Suite teaches strategies for non-traditional funding sources such as stationary accounts, communications, technology, and vehicle financing. You can spread your outgoing expenses to improve your liquidity and/or cash flow.

- A realistic 6-to-9-month timeline paired with coaching ensures you achieve tangible results. This is faster than the average business funding back-and-forth with fewer chances of rejected applications.

- Rather than providing you with financing itself, Credit Suite prepares you for financing so you can maximize each application submitted to any and all matched partners. This benefits transparency by removing lender bias, as the goal is to link your business with the most favorable limits and repayment conditions.

- Credit Suite guides you to find any existing business credit reports you may have, helping you know where you stand from the first day.

- Experienced business credit coaches are on-hand to guide you through every customized step of the way with real, productive financial information.

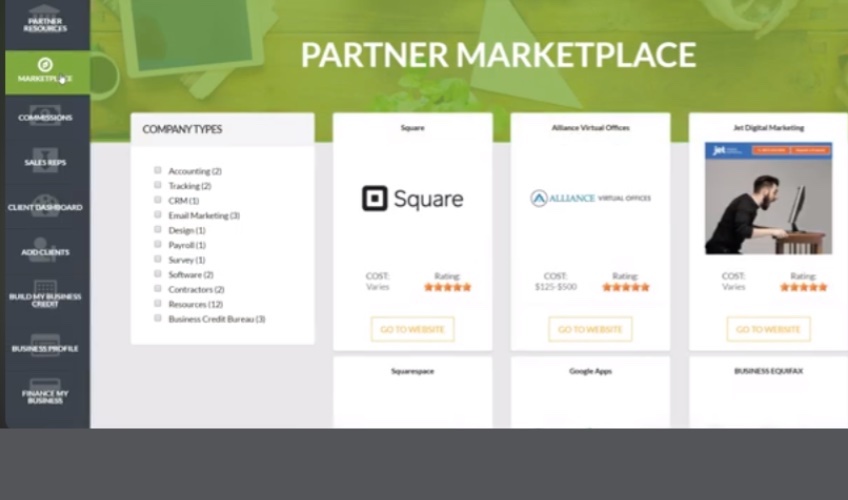

- Integrated business tools are available in the marketplace to streamline operations and alleviate some of the burden of things like accounting.

- You can establish an affiliate partnership to offer these services through your own branded site while Credit Suite’s team performs the work for you.

- Robust social proof and educational resources like Credit Suite’s YouTube channel are there to build trust in the process and help navigate the platform.

Credit Suite Cons

- The Core and Fundability programs are confusingly split across two pages and the differences between them are far too nebulous. Moreover, things become even more confusing when it comes to choosing a payment plan since the features don’t seem to change.

- Potential subscribers may become frustrated by the lack of an immediate response from the chatbot when asking clarification questions about pricing, especially if they have to wait a week or more for an email reply.

- There’s no free trial, which can deter those wanting a hands-on experience before committing.

- The website provides ample information through its extensive FAQs, but there’s considerable industry jargon site-wide, which discourages interest and engagement.

Credit Suite Review: The Details

You’ll find several unique and noteworthy features on Credit Suite. From its actual offering to its user interface and customer service experience, there are many things to consider when deciding if the platform is right for you.

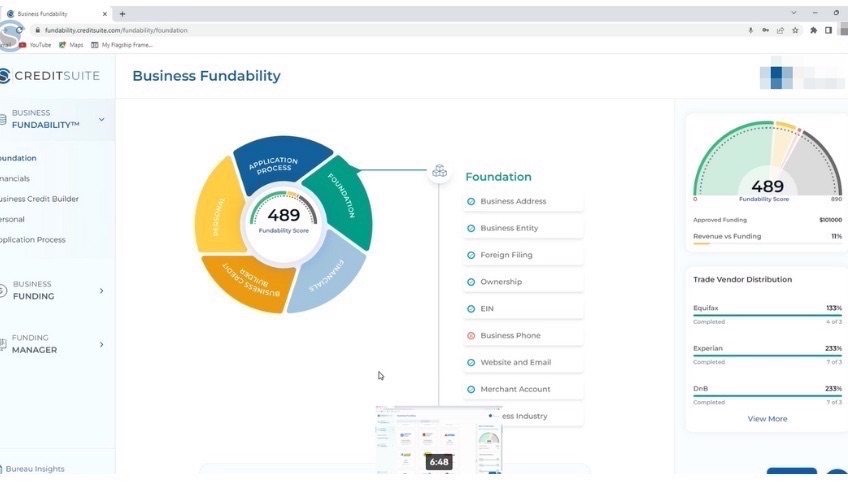

Fundability Foundation: Credit Suite’s Fundability Foundation feature conducts a series of checks on a business’s name, address, website, email, and phone number. These checks assess crucial details to ensure your business presents itself professionally. Newly established LLCs can benefit from this assessment by confirming that their fundamentals are set up properly.

This feature also gives subscribers guidance on setting up business bank and merchant accounts. For example, it can help a small retail business establish an employer identification number.

As for funding, the tool grants access to a wide variety of programs and high-limit revolving accounts. This pairs nicely with Fundability’s training on business credit and score improvement techniques, which can help you understand how to enhance how attractive you are to lenders.

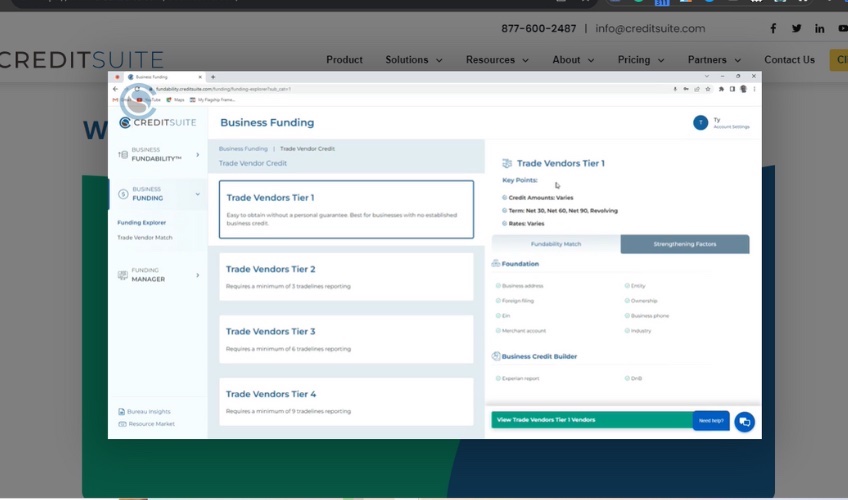

Small Business Lending: Whether you’re launching a startup, scaling an existing business, or operating long-term, accessing the proper financing is crucial for your venture’s success. Credit Suite’s lending programs cover a wide range of financial needs for various business profiles.

First is the Credit Line Hybrid loan program, which provides up to $150,000 in unsecured, no-documentation loans at 0% interest. Your personal credit history plays a heavy role in this plan’s approval, so if you’re founding a new startup with great personal credit but little or no business history, this could be ideal.

On the flip side, thriving businesses like online retail stores that process many transactions via credit cards can benefit from the Merchant Cash Advance loan type, which eliminates the need for proof of financials and related documents—just a quick review of bank statements will suffice.

Additional loans are suitable for all kinds of businesses and situations, including:

- Businesses with steady cash flow but bad credit

- Startup owners and entrepreneurs with retirement assets

- Businesses with average credit in need of new equipment

- Business owners who have stocks and bonds as collateral

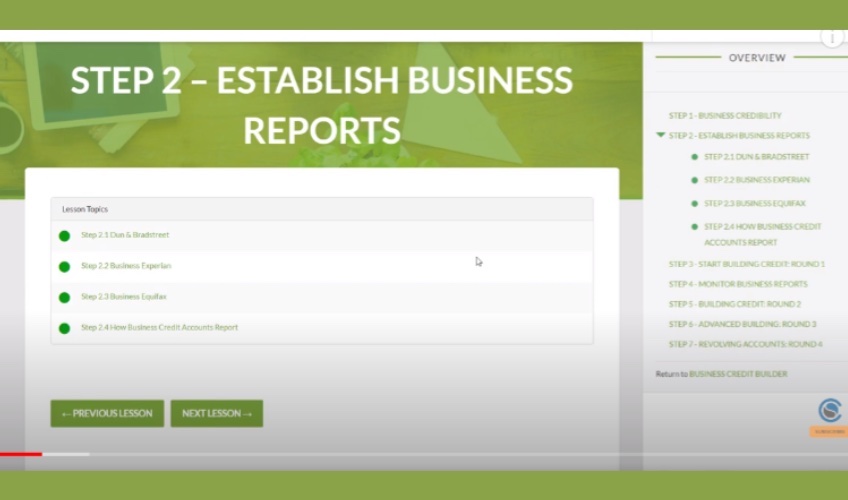

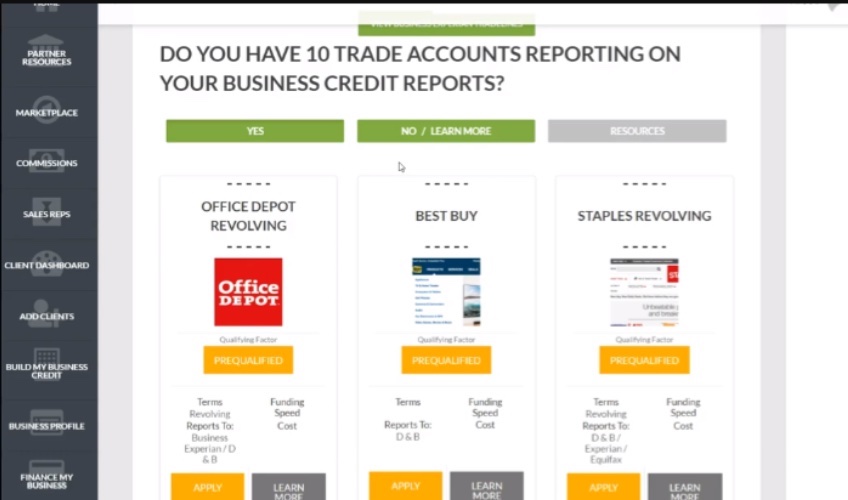

Business Credit Builder: Credit Suite’s Business Credit Builder program offers various benefits to entrepreneurs, small business owners, and mid-size business owners alike.

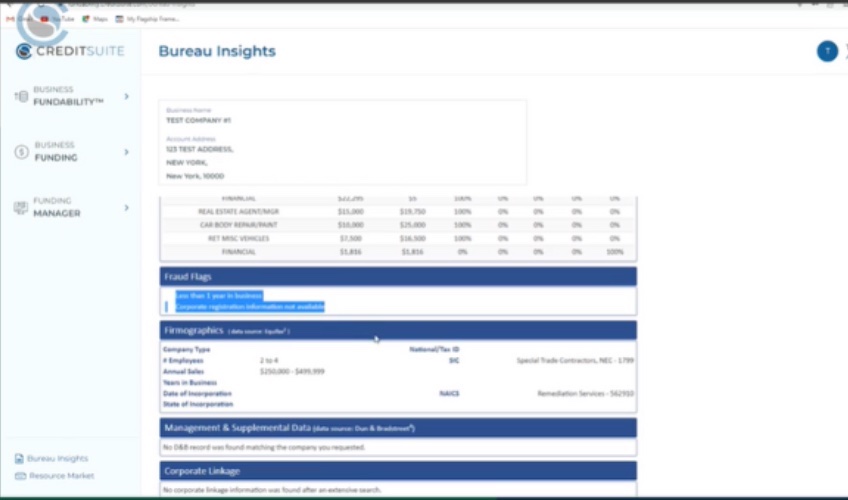

First, the program has you set up accounts with Experian, Equifax, and Dun & Bradstreet to develop a clearer understanding of how lenders view business credit scores. This kind of insight can help you gauge lender standards and see where you can make improvements, which is especially valuable if you’re planning to apply for major financing in the future.

Once registered with the credit bureaus, businesses can access revolving credit options ranging from $5,000 to $50,000. This flexible financing could help with various business operations, such as handling irregular inventory needs during high-demand seasons.

Additionally, the Credit Builder feature provides ongoing support from a team of dedicated credit and financial advisers—which is particularly helpful for new businesses and/or anyone who isn’t used to building and managing credit.

Business Finance Suite: The Business Finance Suite is a multifaceted tool for business owners seeking improved financial options. Its comprehensive dashboard guides users through building credit profiles while simplifying the approval process.

By revealing how a company’s data appears to lenders, the Bureau Insights feature can address specific problems hampering your ability to obtain credit lines. It’s also nice to have everything in one centralized place, since that makes it easier to create an ongoing financing strategy.

The onboarding process is thorough, with videos and resources that break down complex credit-building steps into achievable tasks. You can also repeat each step as needed, since the educational content is there for you to go over whenever you want.

Another advantage involves matching qualified businesses with suitable lenders through the Finance My Business stage. Rather than endless rejections, this system connects clients to realistic funding partners with similar goals.

Non-Financial Credit: While traditional loans require extensive paperwork and personal guarantees, Credit Suite opens diverse new credit lines without credit checks or collateral.

This is particularly beneficial for those who can’t secure a traditional business loan but need work-related items on credit. A construction company, for example, could use these credit options to invest in necessary construction supplies.

Beyond day-to-day supply needs, you can also use credit for marketing and acquisition purposes by utilizing credit cards with high limits. This reduces your out-of-pocket costs while improving your chances of finding new leads and clients.

Partner Program: With Credit Suite’s partner program, you can offer your own clients financing solutions so they can spread their costs and gain access to dedicated support. The partner program won’t suit everyone, but there are plenty of businesses that would benefit from offering their customers financing options.

In addition to securing funds, the partner program equips you with extensive marketing resources to launch campaigns and promote your newly expanded capabilities. There’s even a centralized dashboard to manage customers, track commissions, and optimize your brand presence.

Perhaps most valuable, the program allows you to take control over monetizing Credit Suite. This means you can set up individual sales reps with a tailored dashboard and outreach tools. As a result, team members will gain autonomy to build relationships and close deals using customized marketing assets—and meanwhile the commission tracking keeps you up to speed.